Umbrella Payslip Explained

Understanding your umbrella payslip is very important because salary skimming, tax avoidance schemes, and unlawful deductions have become part and parcel of the umbrella company market. Unsurprisingly, some of the most popular umbrella companies have been found to be involved in such unlawful activities.

In times like these, one thing can be a saving grace, and that is your umbrella company payslip. The chances of you being duped by an umbrella company reduces significantly if you review your payslip every single time you receive it.

Understanding the payslip is actually not that difficult. It's all about paying attention to details. At the same time, it's quite possible that the payslip data could be overwhelming to some people. In such cases, it's best to seek advice from an umbrella company expert.

In this article, we will try and explain you how to check and audit an umbrella company payslip.

What is a payslip?

Payslip is a document that is issued to a temporary worker every time they are paid. It contains details such as Tax Code, National Insurance number, pay report, deductions etc.

The payslip will reflect the income received by the umbrella company from the agency. There shouldn’t be any discrepancy between the amount reflected in the payslip and the amount committed to you by the agency/end-client.

What is included in the umbrella payslip?

An umbrella payslip would typically include Gross income, deductions – Income Tax and National Insurance Contributions (NIC), Employer Pension Contributions, salary sacrifice, student loan payments, Apprenticeship levy etc. What is included in the umbrella company payslip would vary on a case-to-case basis and also depends on the Software being used by the umbrella company.

You may also see a mention of “Holiday Pay” on your umbrella payslip. You would see this if you have requested for a holiday pay. This amount will be added to your taxable gross pay. If you asked for an advanced holiday pay to be paid out with each week as advance, then it would reflect in your payslip as holiday pay advanced.

A standard payslip will include:

Company Income Received

- Company Income & Costs

- Apprenticeship Levy

- Employer’s National Insurance Contribution

- Employer’s Pensions Contribution

- Umbrella Company Margin

Employee Details

- Name

- Employee Number

- Tax Code

- National Insurance Number

- Pay Date

- Period (Weekly/Monthly)

Payments

- Basic Rate

- Holiday Pay

- Additional Taxable Wage

Deductions

- PAYE Income Tax

- Employee’s National Insurance Contributions (NICs)

- Employee's Pension Contribution (if applicable)

- Student Loan (if applicable)

Umbrella Illustration

- PAYE Reference Number

- Tax Period

- Period Ending

- Pay Frequency (Weekly/Monthly)

This Period

- Total Taxable Pay

- Earnings for NICs

- Expenses

- Net Payment

Year To Date

- Total Taxable Pay

- Total Niable Pay

- PAYE Income Tax

- National Insurance

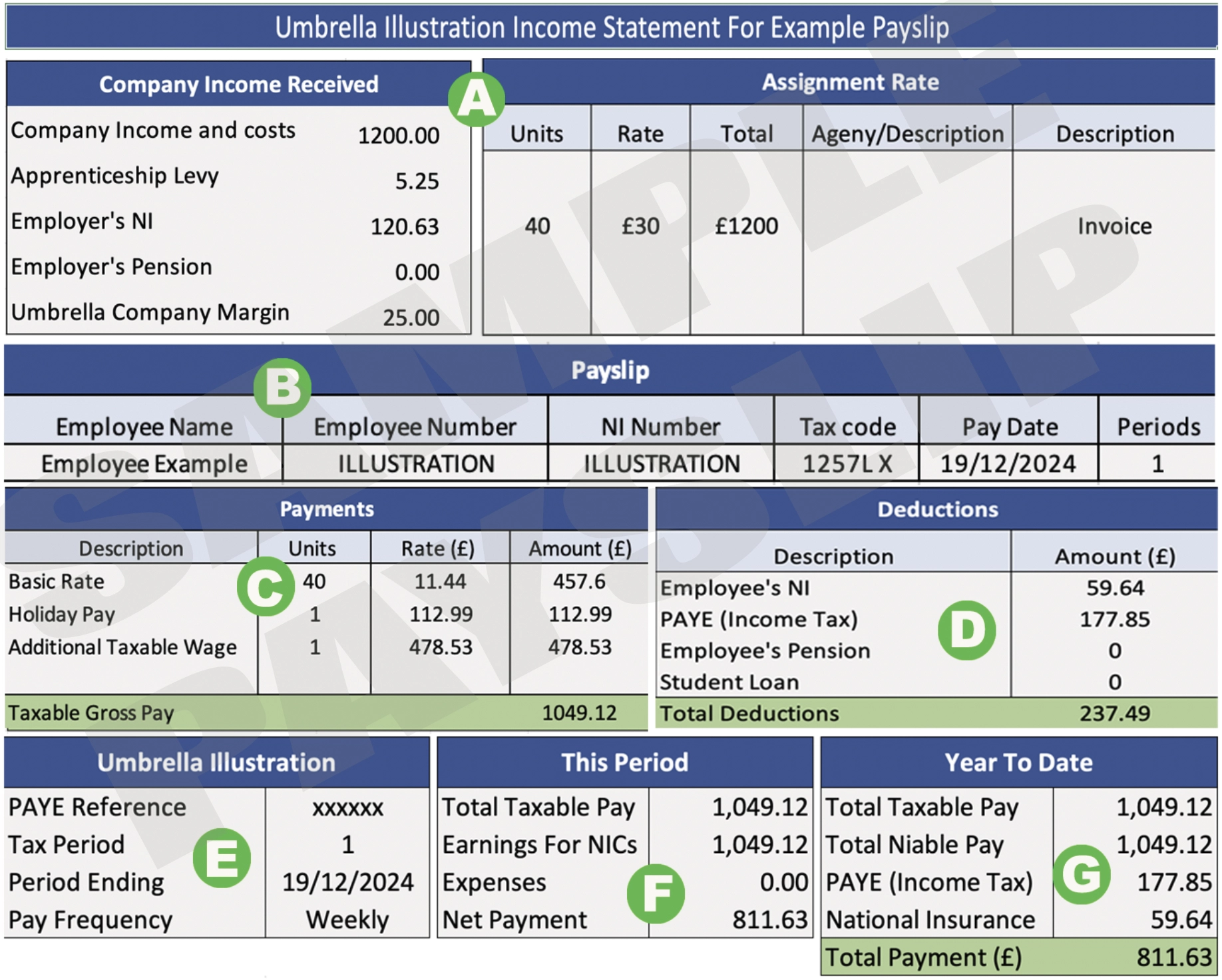

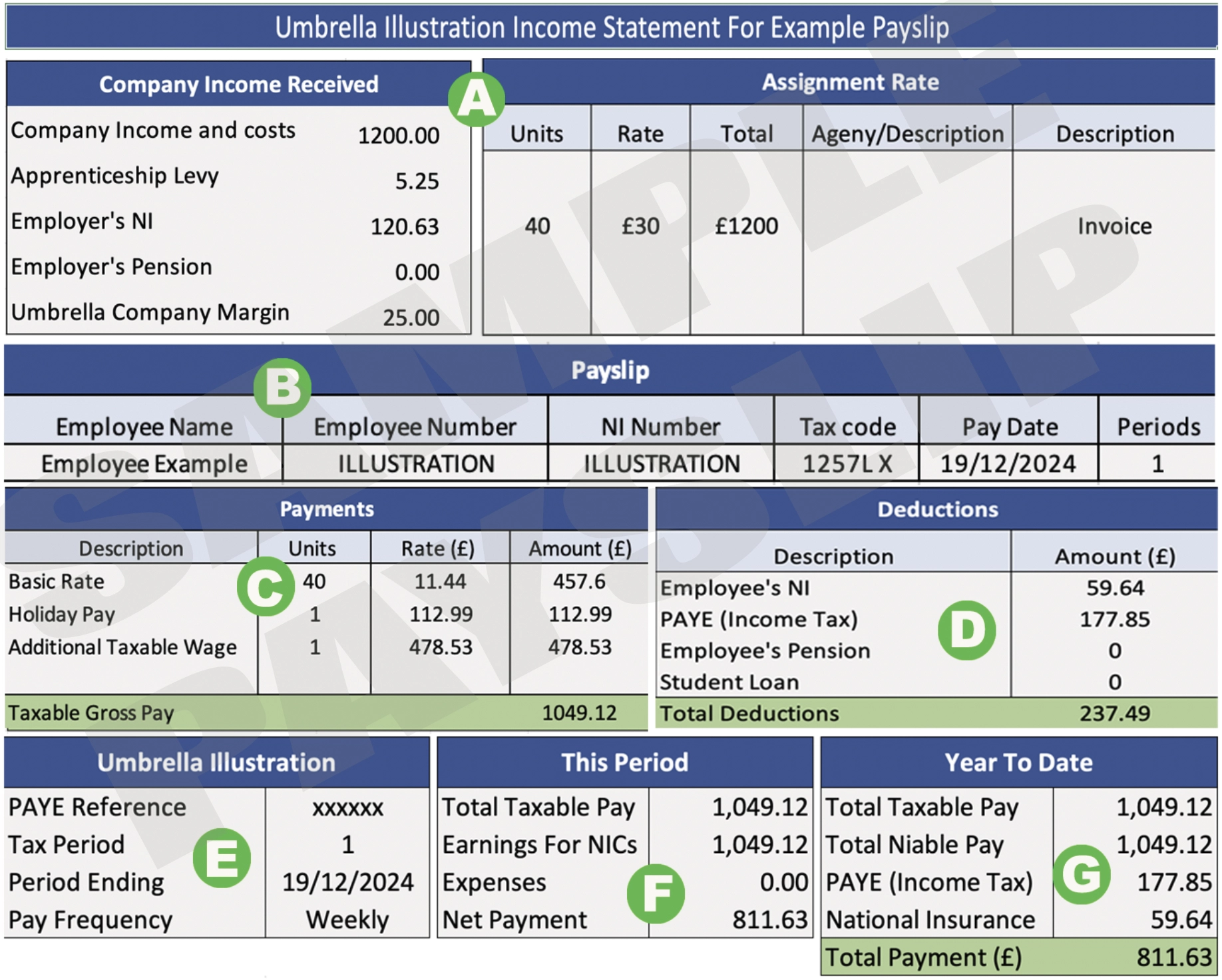

Payslip Breakdown with Key Details and Calculations

(A) Company Income Received:

- Company Income and Costs: This represents the total earnings the umbrella company receives from the recruitment agency or end-client. It is calculated as the assignment rate multiplied by the number of units (e.g., days or months).

- From the assignment rate, the umbrella company will make the following deductions, which will result in your taxable gross pay:

- Apprenticeship Levy: 0.5% of assignment rate.

- Employer’s National Insurance Contribution: 13.8% on earnings above £9,100.

- Employer’s Pension Contribution: 3% if opted into a workplace pension scheme.

- Company Margin: A fixed fee retained for payroll processing (weekly/monthly).

(B) Payslip – Relevant Employee Details:

- Employee Name: Your name.

- Employee Number: A unique payroll number.

- National Insurance Number: Your NI number.

- Tax Code: Your allocated tax code.

- Pay Date: Date of payment and payslip generation.

- Periods: Duration covered (e.g., weekly or monthly).

(C) Payments – Allocation of Taxable Gross Pay:

- Basic Rate: Hours worked × National Minimum Wage (NMW).

- Holiday Pay: Calculated at 12.07% of taxable gross pay.

- Additional Taxable Wage: Remaining balance after National Minimum Wage (NMW) and Holiday Pay.

(D) Deductions:

- PAYE (Income Tax): For 2024/25 tax year:

- 20% on earnings up to £37,700 (Basic Rate).

- 40% on earnings between £37,701 and £125,140 (Higher Rate).

- 45% on earnings above £125,140 (Additional Rate).

- Employee’s National Insurance Contributions (NICs):

- 8% on earnings above £12,570 (Primary Threshold).

- 2% on earnings above £50,270 (Upper Threshold).

- Employee Pension: 5% if opted into Workplace Pension Scheme.

- Student Loan: Deducted based on repayment plan, if applicable.

(E) Umbrella Illustration:

- PAYE Reference Number: Your PAYE reference.

- Tax Period: Payment period covered.

- Payment Frequency: Weekly/Monthly.

- Total Taxable Pay: Earnings subject to tax.

- Earnings for NIC: Amount subject to National Insurance.

- Expenses: Allowable expenses (if applicable).

- Net Payment: Final payment into your bank account.

(F) This Period:

- Total Taxable Pay: Earnings subject to tax.

- Earnings for NIC: Amount subject to National Insurance.

- Expenses: Allowable expenses (if applicable).

- Net Payment: Final payment into your bank account.

(G) Year To Date:

- Total Taxable Pay: The total amount of earnings subject to tax since the beginning of the tax year (i.e., April 6th).

- Niable Pay: The total amount of earnings subject to National Insurance Contributions since April 6th.

- PAYE (Income Tax): The total amount of PAYE tax paid since April 6th.

- National Insurance: The total National Insurance Contributions paid since April 6th.

Umbrella Payslip Example

Below is a real-life example of an umbrella payslip with deductions:

For a weekly payment cycle, where you work at an hourly rate of £30 for 40 hours, and the weekly umbrella company margin is £25, your payslip would appear as shown in the sample below.

Example of an Umbrella Payslip for Reference

A payslip example is also available on the government's website: Gov.uk

How to check and verify the accuracy of an umbrella payslip?

Before any money is credited to your bank account, there are some deductions which take place at umbrella company’s end. They are mainly Income Tax and National Insurance deductions. If an umbrella company is involved in tax avoidance, they’ll surely leave a mark/clue for you. If you pay attention to the payslip, you will be able to find out the discrepancy in your payslip.

Top tax avoidance signs to look out for on your umbrella company payslip:

- If the amount credited in your bank account is different than the amount shown in your umbrella payslip, then this an indication of tax avoidance.

- It can be a strong indicator of tax avoidance if you have received an “additional payment” in the form of either:

- Loan

- Grants

- Salary advances

- Capital payments

- Credit facilities

- Annuities

- Profit share

- Shares and bonuses

- Amounts held in fiduciary capacity

- Any payment made by the umbrella company that is not subject to PAYE is an indicator of tax avoidance.

- You may also notice that while the number of worked hours is reported correctly, there may be a difference in the pay rate – a reduced pay receipt. The pay rate and the worked hours should match. If it doesn’t then there’s a high probability of tax avoidance.

- If you find any hidden charges on the payslip or charges that are not itemised or the values are not matching or reported correctly, then this is potentially salary skimming

You can also use the tools suggested by the government to check whether the deductions are correct or not. If you have any query regarding your umbrella company payslip, please feel free to write to us on [email protected], and we will try our best to assist you.

Interested in a FREE take-home pay calculation?